Our friends at Slightly Foxed (the real readers’ quarterly – buy a subscription now!) have once again kindly allowed The Dabbler to dip into its rich archives.

With the world’s financial markets once again in turmoil, we thought this article from the Spring 2010 edition (issue 21) would be appropriate, as Robert Bruce examines the human psychology of boom and bust…

When Northern Rock first ran into trouble in the autumn of 2007, worried customers queued outside branches from the early hours in an attempt to get their money out. ‘This is the first run on a British bank since Mary Poppins,’ said someone. It was one of those easy jokes which succinctly sum up what is going on. In the film Mary Poppins the run on the bank is a mistaken one, triggered by a child loudly demanding the return of the money which a benign father has banked for him. The idea that depositors might lose their money in Northern Rock was equally mistaken.

The credit crunch has been a difficult but exciting time for financial journalists. After all, chaos and crisis are what we journalists really enjoy most. It has also been a baffling time. Almost any expert you cared to call had no real idea what was going to happen next and what the best remedy might be. But friends and family, and sometimes total strangers, tended to ignore this. A financial journalist ought, they thought, to know some of the answers. In fact the only wisdom I could offer was that an understanding of human nature was likely to be a better guide than economics. The last thing which would be of any use was books on business or management. Almost universally these are worthless, though occasionally enjoyable. But still people wanted help in understanding what might happen next, or what was happening day-to-day.

And for that there were really only two things I could provide. I could hand them my dog-eared paperback copy of J. K. Galbraith’s The Great Crash, 1929, which provides an astonishingly vivid account of what happened the last time around and which makes it clear that almost everything that happened then is also happening now. Then as now, bankers tried to save their own skins and politicians filled the air with pledges, overarching solutions and grandiose schemes.

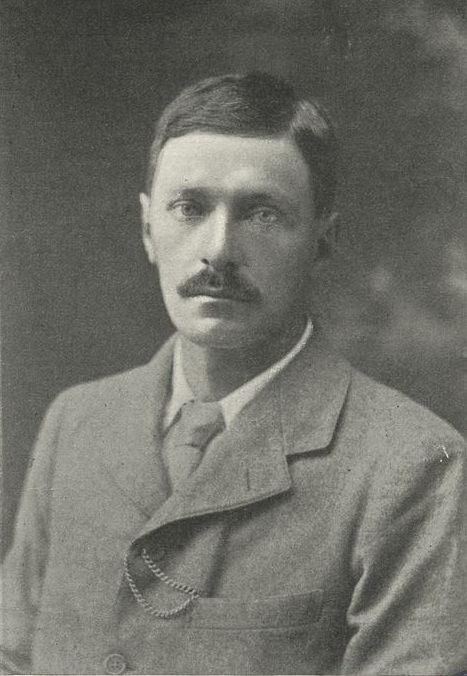

But the book which best fits the bill is one which has long been a favourite of mine. And frankly its title alone tells you all you need to know about financial crises. It is called Where Are the Customers’ Yachts? It was written, in relative tranquillity, by a modest man called Fred Schwed Jr. in 1940. In it he recalls the couple of years in which he worked on Wall Street just before 1929. Its power lies in its simplicity, though it does explain a few financial concepts along the way, and in the way in which it sticks solidly to the view that human nature and human failings have much more to do with the workings of the financial markets than any serious technical knowledge.

The book’s title was, as Schwed points out, a very old Wall Street joke even when he first started working there. It dates back to the 1870s and comes from a remark made by an onlooker on a summer’s day in Newport, Rhode Island. Several people were gazing at the vast yachts sailing to and fro. ‘Look, those are the bankers’ and brokers’ yachts,’ said one man. And, in the manner of someone pointing out that the Emperor had no clothes, another responded: ‘Where are the customers’ yachts?’ Schwed always claimed that this line became the sole basis for the book’s fame, even though it also had a subtitle: or A Good Hard Look at Wall Street. When he wrote a new introduction to the 1955 edition he said: ‘In my travels I have found that the number of people who know of this book, but have never happened to purchase a copy, is remarkable. In all this time, rarely has no eye lighted up when I casually rammed Where Are the Customers’ Yachts? into the conversation. This immortality is all attributable to just five words out of a 40,000 word text – the five words of the title.’

He is being too modest. The real value of the book lies in his approach. This again is a simple one. He refers to another old Wall Street joke: that it is a street with a river at one end and a graveyard at the other. ‘This is striking’, he says, ‘but incomplete. It omits the kindergarten in the middle, and that’s what this book is about.’ Schwed goes on to describe the basis of a day’s work on Wall Street.

What we are constantly exchanging, over the incredible network of wires, are quotations, orders, bluffs, fibs, lies, and nonsense. The first four are the necessary agenda of doing brokerage in securities. The downright lies are rather exceptional, and in the long run prove to be unprofitable business practice. The chief concern of this book will be with an examination of the nonsense – a commodity which keeps sluicing in through the weeks and years with the irresistible constancy of the waters of the rolling Mississippi.

The creation of a financial disaster requires eager participants on all sides. It is never just about a bunch of charlatans selling something worthless to the gullible dupe. And often, in the midst of the mess, are the politicians. This view is also at the heart of Galbraith’s book. ‘This notion that great misadventures are the work of great and devious adventurers, and that the latter can and must be found if we are to be safe, is a popular one in our time.’ This is equally true in our own times. As Galbraith goes on to say:

No one was responsible for the great Wall Street crash. No one engineered the speculation that preceded it. Both were the product of the free choice and decisions of thousands of individuals. The latter were not led to the slaughter. They were impelled to it by the seminal lunacy which has always seized people who are seized in turn with the notion that they can become very rich. There are many Wall Streeters who helped to foster this insanity, and some of them will appear among the heroes of these pages. There were none who caused it

But that, as we know, doesn’t mean that recriminations, if not attempts at downright bloody revenge, will not be in the air. Schwed calls it ‘the ancient human tendency to personify general misfortune in some human shape’. Perceptively he says: ‘While “hundreds of thousands are being plunged into poverty” only the thoughtful ask: “What is happening to us?” The popular cry is “Who is doing this to us?” and its satisfying sequel – “Just let me get my hands on him!” The public goes raging about like an infuriated mob with a rope.’

Economics takes a rational approach to finance, but, as Schwed points out, human nature is always the better guide. At the outset he lets the reader know that there won’t be much in the way of financial thinking in his book. ‘The reason is that I wouldn’t discuss economic profundities if I could, and beside, I can’t. My method of dealing with those subjects which I have never been able to understand will be to omit them, though this is not the customary method of writers on financial topics.’

That clears the decks and allows human frailties to come to the fore. Schwed draws our attention to ‘The sad truth that pitifully few financial experts have ever known for two years (much less fifteen), what was going to happen to any class of securities – and that the majority are usually spectacularly wrong in a much shorter time than that.’ Elsewhere he remarks that ‘The more skilful of these traders can, and do, peer into the future for a period of five or even twenty minutes concerning those securities which they are actively trading. This short-term peering is a legitimate function because plenty of hints are pouring in to them all the time on many wires. However, as soon as they get a moment of leisure they try peering into the future for five or ten months. For this they are precisely as ill-equipped as everybody else.’

That would be fine if people accepted it as the basis of the relationship between investors, regulators, investment bankers and particularly politicians. But they don’t. They all go for certainty. ‘Customers’, as Schwed says, ‘have an unfortunate habit of asking about the financial future. Now if you do someone the signal honour of asking a difficult question, you may be assured that you will get a detailed answer. Rarely will it be the most difficult of all answers – “I don’t know”.’

And every so often down the years the whole process will gather an unstoppable momentum. And everyone will be very surprised, even though the signs were there for all to see. If all is going well people don’t want to believe that it might not be. Galbraith quotes a remark of the great journalist and constitutional historian Walter Bagehot: ‘All people are most credulous when they are most happy.’

So what do these delightful books tell us? Well, there is nothing new under the sun. ‘By affirming solemnly that prosperity will continue, it is believed, one can help insure that prosperity will in fact continue,’ says Galbraith. ‘Especially amongst businessmen the faith in the efficiency of such incantation is very great.’ Or, as Schwed says: ‘It is hard to sell Americans a proposition that hasn’t the promise of a little zip to it.’ And in that sense we are all Americans now.